14.11.2024

Webinars

Due Diligence under the EU Batteries Regulation: Preparing for next year’s compliance requirements

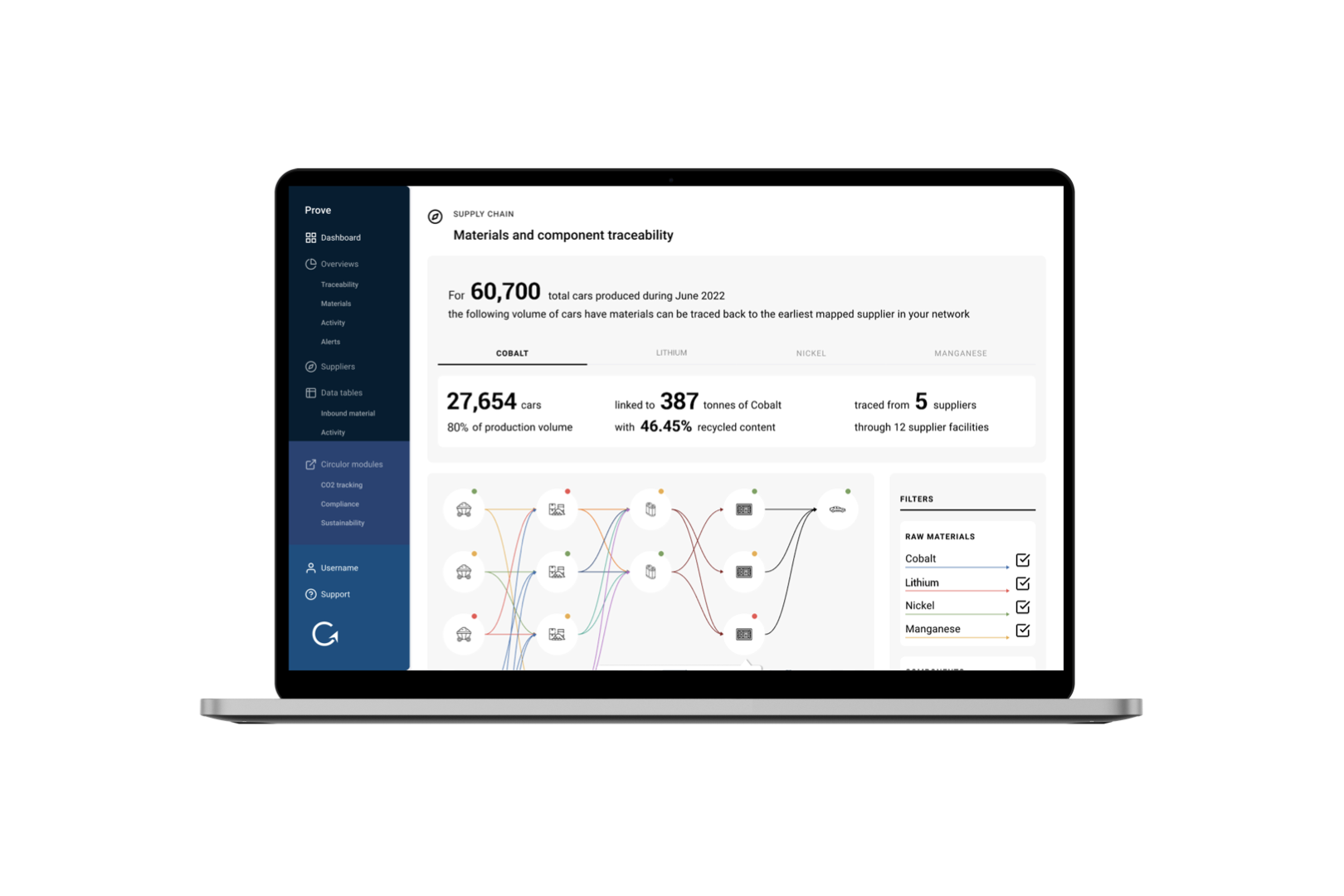

Kumi and Circulor hosted an essential webinar on how to navigate and prepare for the EU Batteries Regulation due diligence obligations, to which companies must implement by August 2025.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)