04.08.2022

White Papers

Inflation Reduction Act

Supply chain transparency required for US EV batteries

The Inflation Reduction Act heralds the largest shift in U.S. climate policy to date, pushing clean manufacturing and incentivizing consumers toward electric vehicles via tax credits.

However, from 2024, for vehicles to qualify for tax credits, automakers must demonstrate that the percentage of minerals within their batteries extracted and processed in the U.S. or in a country with which the U.S. has a free trade agreement meets the threshold qualifying criteria.

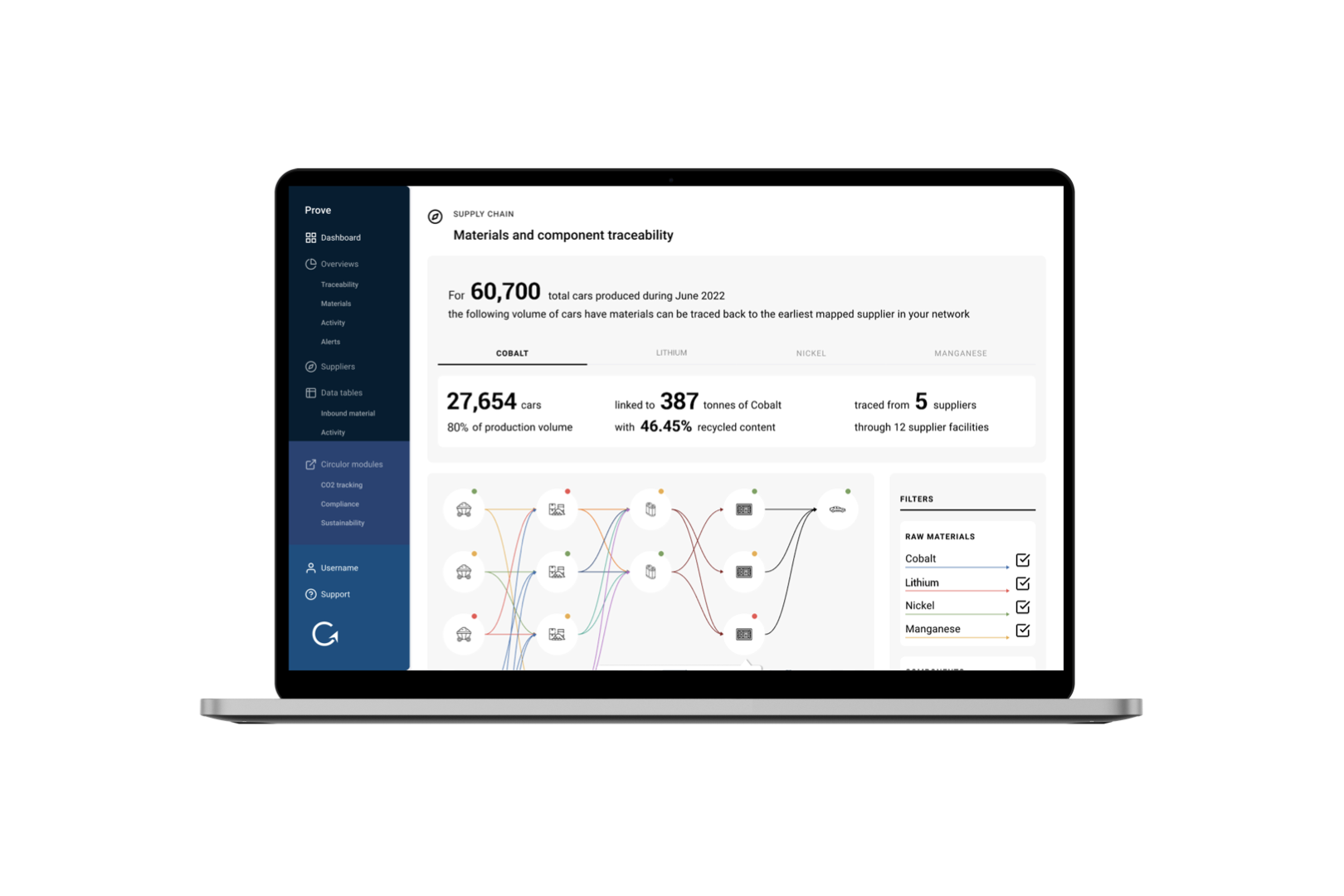

Comply by building a transparent EV supply chain

Everything you need to measure your battery supply chain and comply with this Act is available today.

We can help your company demonstrate where you source, produce and recycle all materials and prove how you are fulfilling the requirements of the U.S. EV tax credit.

For more information, please contact us or download our whitepaper.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)