28.02.2024

News

February 2024 Newsletter: The evidence is clear - proving strong ESG practices unlocks long term investments

One clear takeaway from Circulor’s presence at recent events for critical mineral and clean energy technologies, is that ESG transparency is high on the agenda when it comes to investors—and scrutiny is ramping up.

We’re hearing first-hand that organizations are increasingly being held accountable for the ESG performance of their supply chains by investors. Investment mandates and pre-deal analyses now incorporate ESG criteria. Consequently, companies that can prove strong ESG performance become a more attractive prospect for investors as they seek to deploy their funds more responsibly into companies who are upgrading their activity due to increasingly stringent regulations.

According to ESGtoday, investors increasingly require ESG and climate data for investment and risk decision making, to monitor investment decisions and to meet growing regulatory disclosure requirements. Bain also endorses this, citing that investors expect more sustainable products, with certifications to back-up companies’ claims. They highlight that the future success of an organization will hinge on establishing a transparent and circular value chain, that minimizes material usage through reuse, remanufacturing, or recycling, reducing both costs and waste.

In their new ‘Sustainable Signals’ study, Morgan Stanley reveals that over half of investors plan to increase their allocations to sustainable investments, including into clean energy, in the next twelve months. Financial returns remain the main priority and investors believe strong ESG practices lead to better long-term returns, but a lack of transparency and trust in reported data causes concerns about greenwashing.

It’s not just private sector financing that is ramping up in clean energy projects. Earlier this month the U.S. Energy Department gave preliminary approval for nearly $710 million in loans to EV technology manufacturing ventures to fund clean energy projects.

What we’re reading

Carbon intensity - an overlooked metric key to the green transition

This recent WEF report shares how leveraging differentiated carbon intensity can drive investment into low-carbon production at scale and speed, introducing competition in traditional trade. However, achieving this requires prioritizing actual data over averages to enable stakeholders to distinguish between low and high carbon sources. It suggests assessing end-to-end supply chains, which is the approach Circulor takes—dynamically aggregating emissions data at each step of production, based on the actual flow of materials, to build a detailed understanding of operational and inherited emissions.

GM to spend $19bn to source EV battery materials from LG Chem

CNBC reports that General Motors intends to spend $19 bn over the next decade through a new supplier deal to source critical materials for use in EV batteries from LG Chem. The long-term supplier contract will see LG Chem supply GM with more than 500,000 tons of cathode materials—including nickel, cobalt, manganese, and aluminum.

Risk specialists call for better battery supply chain ESG visibility

Supply Chain Digital highlight the lack of transparency around the sourcing of battery metals, particularly ESG violations such as forced labor, in the EV battery supply chain. They quote risk management specialists Resilinc, who say that “it is vital that organizations safeguard their supply, reputation, and bottom line, and that EV manufacturers in particular must ensure their associated supply network is as compliant as possible.”

Lamborghini targets 40% reduction in emissions across the value chain by 2030

IItalian luxury sports car manufacturer Lamborghini announced a new climate commitment aiming for a 40% reduction in CO₂ emissions per car across its entire value chain by 2030, ESGtoday reports. This pledge aligns with its sustainability strategy, launched in 2021, focusing on electrification and decarbonization efforts. Lamborghini aims to introduce its first fully electric model in 2028 and an electric SUV in 2029, targeting a 50% reduction in fleet CO₂ emissions by 2025 and 80% by 2030.

The race to green steel is on!

According to Axios, climate NGOs are uniting to encourage automakers toward the adoption of steel produced with low-carbon methods. Steel production is a top driver of climate change due to its heavy reliance on coal. Despite the fact that clean steel is rare and more expensive today, it can be done at less than 1% more for the cost of the average vehicle.

What we’re sharing

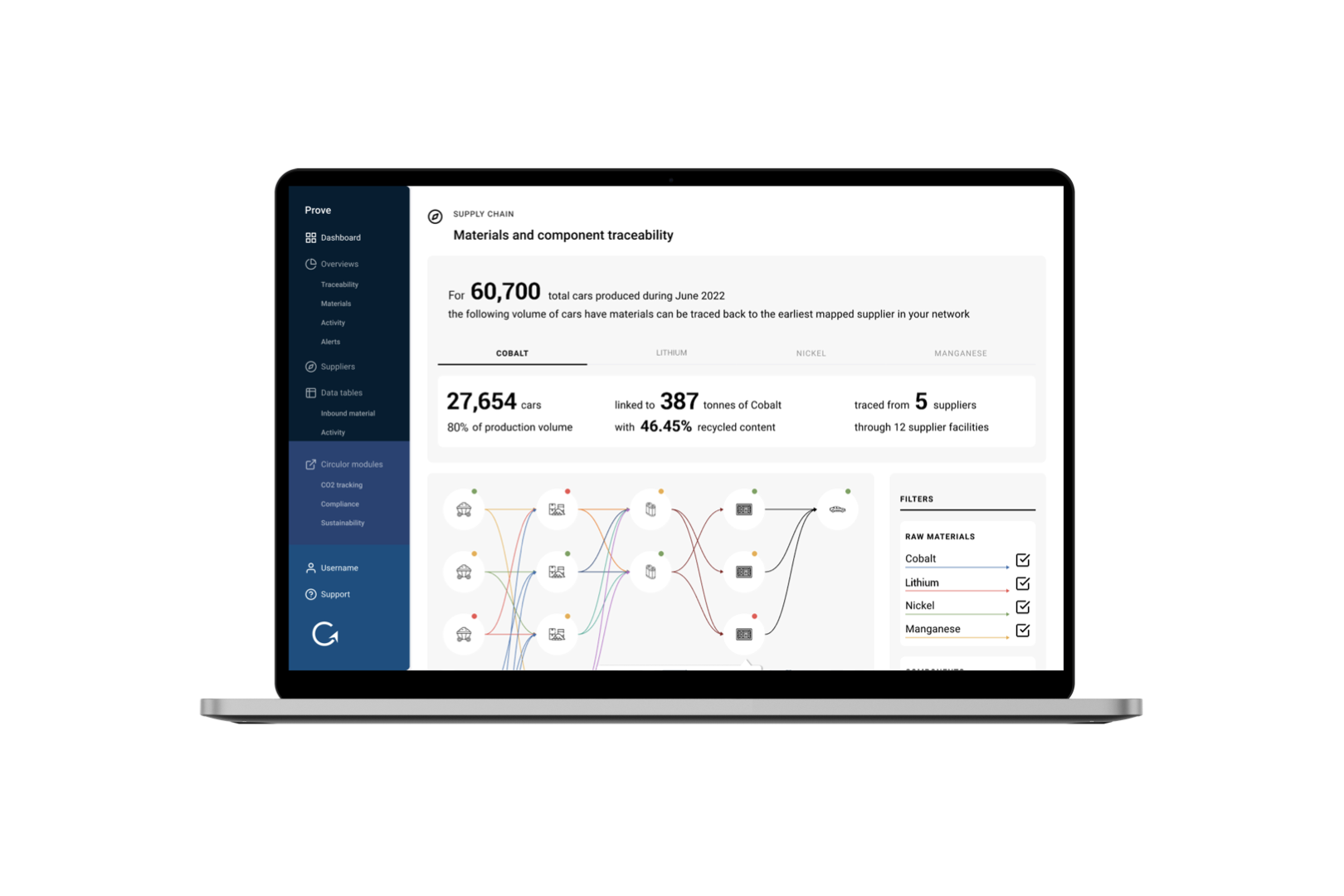

Why the need to start deploying material traceability today?

Last week, February 18, 2024, marked the official application date of the EU Battery Regulation with increasingly stringent elements of the regulation now being phased in. While its complete implementation will unfold over time, organizations must initiate material traceability in their supply chains promptly if they are to meet the deadlines. It not only ensures compliance with evolving regulations but also provides a competitive edge and management of supply chain risks. Read more.

Unlocking circularity for products placed on the market

As well as fulfilling regulatory requirements, Circulor's Digital Product Passport enables companies to unlock the advantages of a circular economy. With Circulor, customers can combine their static product information with traceability and emissions data from their supply chains to provide proof of material provenance and the production journey along with inherited CO₂-e emissions, proof of compliant sourcing requirements, recycled content quotas and collection targets as products reach end-of-life. Read more.

ACC raises $4.7bn to build Gigafactories across Europe

ESGtoday reports that Circulor customer ACC, a European EV battery leader that is industrializing the next generation of clean transportation, plans to build three gigafactories for lithium-ion battery cell production in France, Germany, and Italy. The company, formed in 2020 as a joint venture by Stellantis, TotalEnergies, and Mercedes-Benz, aims to be a leading supplier of EV batteries with a focus on safety, performance, and low carbon footprint. Read more on the Circulor and ACC partnership.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)