25.10.2023

News

October 2023 Newsletter: Embedded carbon emissions garner larger, brighter spotlight on both sides of the Atlantic

The second half of 2023 is shaping up to be an important defining moment for embedded carbon emissions—especially for heavy industry. This month, Europe’s Carbon Border Adjustment Mechanism (CBAM) begins to take hold, as carbon-intensive goods including cement, steel, fertilizer, and electricity must start reporting their emissions to gain access to Europe’s market and deliver on the region’s promise to create more transparent and sustainable business practices.

This period of implementation for CBAM will run from October 2023 until December 2025, after which imports will then need CBAM certificates, and import taxes will be applied for those products that exceed specific emission thresholds.

Looking to the U.S., while the world’s largest economy may not have one signature policy priority like its European counterparts, several market drivers are now in place, or soon coming into place, that require proof of upstream emissions.

The most poignant message in this area was sent by California on 11 October. Via California Senate Bill 253, companies with more than $1B in revenue must disclose Scope 1 and 2 emissions by 2026 and Scope 1, 2, and 3 by the beginning of 2027. Potentially affecting 5,300 businesses throughout the state, the bill also requires companies to report their emissions to California residents in a “manner that is easily understandable and accessible” and ensure disclosures are independently verified by a third-party auditor.

While the U.S.’s Security Exchange Commission stands waylaid in setting emission guidelines at the national level, other agencies inside the Beltway are moving forward with requiring embedded carbon emission data. As the largest purchaser in the world, the U.S. federal government, via President Biden’s Executive Order 14057, is using its $630B annual procurement budget to prioritize low-carbon building materials in federally funded projects.

This federal initiative also extends to states through the “Federal-State Buy Clean Partnership,” which was signed this year between the Biden Administration and California, Colorado, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, Oregon, and Washington. Together—and in using funds from Inflation Reduction Act and Bipartisan Infrastructure Legislation—this group is to collaborate in sending a clear demand signal to the marketplace for lower carbon emission products.

Our latest blog shares more on the global market dynamics involving how companies will need to demonstrate the carbon intensity of their supply chains. And while there’s growing momentum in the space, there’s also a growing patchwork of requirements that can become onerous for companies. Starting today will be key for companies as we find that those that do can:

- Future-proof their business,

- Strategically handle risk and uncertainty,

- Facilitate supplier collaboration and evaluation with ample time, and

- Solidify a competitive advantage.

We look forward to continuing to bring you these global insights both here, as well as on circulor.com and LinkedIn. More on the latest global traceability trends below.

What we're reading...

California's climate laws set both precedent and concern for implementation

California recently enacted pioneering disclosure laws in Senate Bills 253 and 261, requiring large companies to report upstream emissions and climate-related financial risks. With the potential for each to affect 5,300 and 10,000 companies, respectively, Governor Gavin Newsom raised feasibility and cost concerns, as well as the need to ensure consistent reporting across businesses that are subject to the measures. The California Air Resources Board is charged with monitoring the cost impacts and streamlining implementation of the programs.

Nickel’s high emissions pose industry barrier to sustainable batteries

Bloomberg explores the significance of nickel, a critical element in electric vehicle (EV) batteries, and how its carbon intensity has become concerning for Umicore, a prominent player in battery value chain. Indonesian nickel is highly carbon-intensive, and although Indonesian industry and government officials have vowed to mitigate the mineral’s impacts, Umicore CEO, Mathias Miedreich put it plainly: “This is probably the biggest risk in supply for electrification of the world—if the CO₂-nickel equation is not actively tackled. If there’s no action, the industry will have a problem

UK’s largest supermarkets seek synergy with EU on deforestation compliance

UK’s major supermarkets are urging alignment with upcoming EU deforestation regulations. Taking effect in 2024, the rules will ban EU imports linked to deforestation and require due diligence proving that goods are deforestation-free. Supermarkets want accelerated UK secondary legislation to prevent disrupted EU exports and uneven standards, and digital product passports are increasingly seen as potential tools for effective product transparency to combat deforestation.

LFP and NMC battery emissions under the microscope

As lithium-ion battery production is set to rise to 6 TWh by 2033, Benchmark's Battery Emissions Analyser (BEA) reveals that mid-nickel NCM batteries emit 4% less emissions than LFP batteries in each cathode type’s best-case scenario. According to Benchmark, while LFPs maintain a cost advantage, their carbon intensity can prove higher than NCM cells even despite the lack of cobalt and nickel. Furthermore, specific sourcing for nickel can tip the balance in terms of a battery’s carbon competitiveness.

Companies bridge current efforts with ESG standards that are taking shape

With emerging regulations like the EU's Corporate Sustainability Reporting Directive imposing stricter ESG disclosure requirements, companies face new challenges in sustainability reporting. The Financial Times explores how firms can effectively meet stakeholder demands and comply with evolving regulations. Panelists discuss the challenges imposed by new standards, strategies to expedite compliance while maintaining accuracy, and how technology innovations can improve data management and reporting efficiency.

GM returns to Europe with Cadillac Lyric

General Motors Co has announced its return to the European market and is already taking orders for the Cadillac Lyric with deliveries expected to commence the first half of 2024. The all-electric Cadillac SUV will offer a range of 530km (about 329.33 mi) and a price point starting at 82,000 Swiss francs. The Lyric kicks off GM’s plans to sell a complete range of all-electric vehicles in Europe by 2030.

What we're sharing...

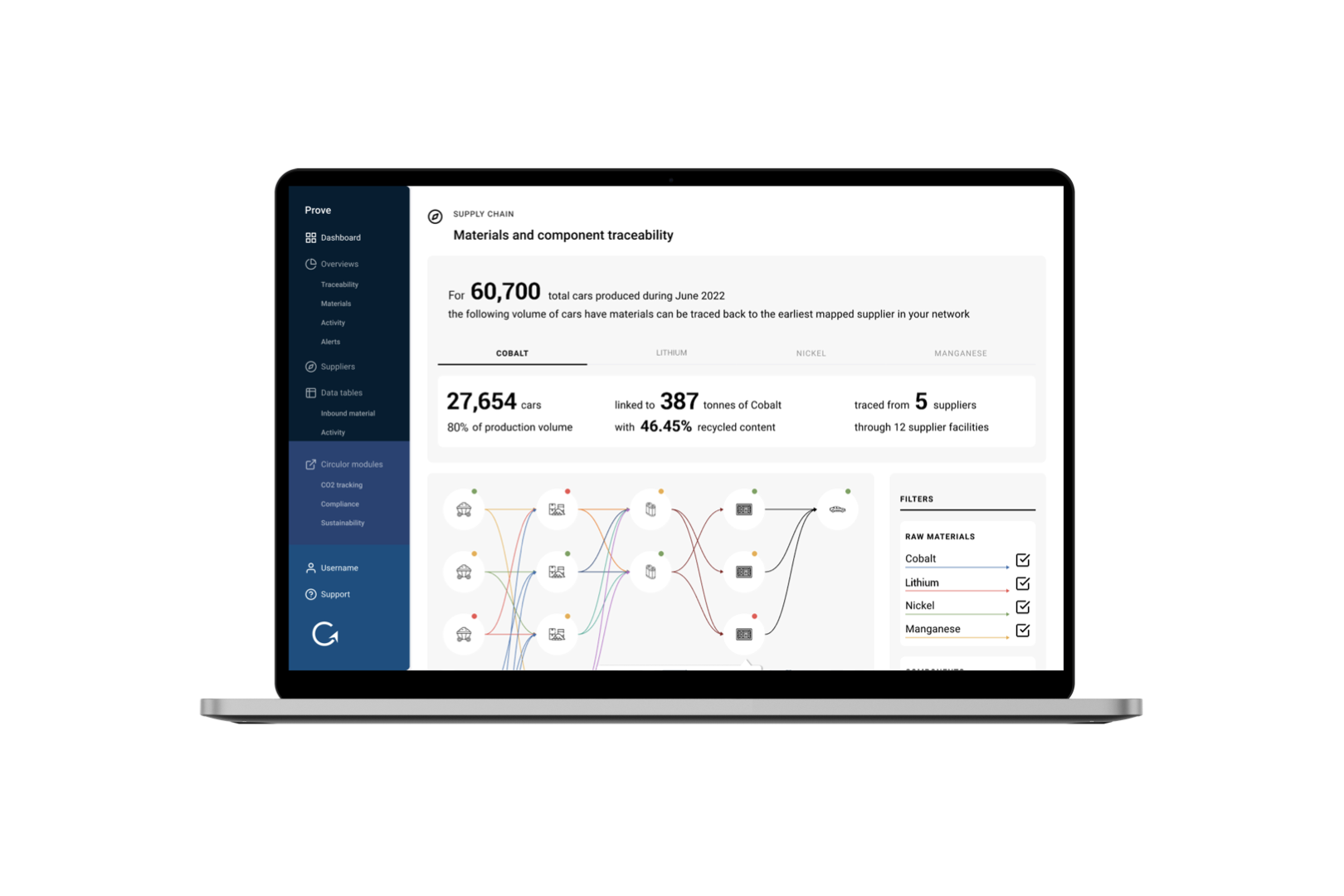

Circulor’s PROVE unlocks supply chain transparency unimaginable until now

Circulor’s PROVE platform provides visibility and proof of activities at all stages of the supply chain, helping organizations to address multiple concerns around increasing global regulations as well as geopolitical, economic and climate risks. The platform is being used at scale by many globally recognized brands.

Oracle Blockchain is a critical component of our traceability solutions

Circulor's partnership with Oracle has paved the way for exceptional confidentiality, security, and scalability in managing procurement relationships. By leveraging Oracle's robust and reliable technology infrastructure, Circulor can facilitate a heightened level of supply chain transparency, especially in the upstream. This synergy allows our clients to navigate their procurement processes more efficiently and effectively, making informed decisions based on data. Read more.

The benefits of Circulor’s scale and network to customers

Circulor’s PROVE platform has the largest battery traceability network on the market—with over 125 facilities connected globally and actively contributing traceability and sustainability data. We work with 52% of global cell manufacturing capacity (by production volume), and this network benefits current and future customers because many suppliers are likely already connected on our platform and implementation of supply chain transparency can be efficient and straightforward. Read more.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)